Wenger himself has always insisted that he would have no problems spending if the right players to strengthen the squad were available, “I would spend £300 million if I find the right player – and if I have £300 million”, though he has also described the current spending levels as “quite scary”.

“Le Professeur” has further explained that English clubs suffer from having to pay a premium, as everyone knows that they are awash with money from the new TV deal, though this does make it even more perplexing that Arsenal did not spend their riches before when prices were much lower.

A couple of years ago £50 million would have bought two world-class players, while it is now barely enough for one. When Wenger was asked about the rise in transfer fees, he said, “We knew that would happen, it was not difficult to anticipate.” Well, precisely, so why keep the powder dry?

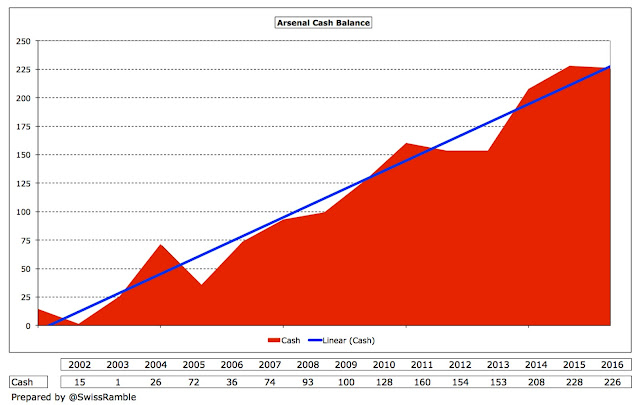

In the latest accounts for the year ended 31 May 2016, Arsenal’s cash balance has very slightly fallen by £2 million to £226 million, but the upward trend remains intact despite the higher spending. In the decade since Arsenal moved to the Emirates Stadium, cash has risen by more than 500% from £36 million to nearly a quarter of a billion.

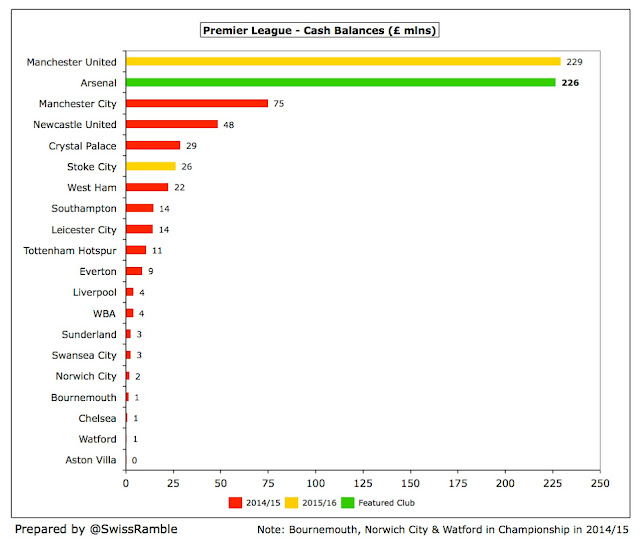

In 2015/16 Arsenal’s cash balance has been overtaken by the cash machine that is Manchester United with £229 million, but the Gunners are far higher than the rest of the Premier League with the closest challengers in 2014/15 being Manchester City £75 million, Newcastle United £48 million and Crystal Palace £29 million.

To further place this into perspective, Arsenal’s cash balance is more than Real Madrid, Barcelona and Bayern Munich combined.

This is nothing new. Since 2007 Arsenal have produced a very healthy £722 million operating cash flow, though a draining £251 million has had to be used for stadium financing (£159 million on loan interest and £92 million on debt repayments) with a further £117 million on infrastructure (“hugely important investments which, whilst not grabbing headlines, will help underpin our long-term future” per Keswick) and £22 million on tax.

Only 20% (£141 million) of the available cash flow has been spent in the transfer market, though virtually all of that (£137 million) has been in the last four seasons. The other notable “use” of cash in that period is to increase the cash balance, which has risen by a cool £191 million.

Major shareholder Alisher Usmanov has noted that Wenger had been put in a very difficult position, as the shareholders did not put any money in to finance the new stadium, which meant that the quarter of a billion incurred to date on stadium financing was not available to improve the squad. That’s obviously correct, but it is equally true that Arsenal have left a lot of available money in the bank to attract one of the lowest interest rates in history, while transfer inflation has been running amok.